VISA Signature Credit Card Opening

Bringing Alliant’s first loan product - credit card application process to mobile app

Overview:

This project introduced the first lending experience within Alliant’s mobile app, a major platform milestone. Until this effort, members were required to leave mobile and complete lending actions through online banking or desktop flows.

Users: The primary audience was existing Alliant members seeking a fast, trustworthy way to apply for a credit card on mobile

Primary Goals:

Establish a scalable mobile lending foundation

Reduce friction in the credit card application process

Align mobile experience with competitor standards

Increase completed and approved applications

Role

Lead UX Designer

6 months

Timeline

Collaboration

Product Owners, Business Owner, Developers, Compliance, Data Analytics, Marketing

Tools

Figma, Medallia DXA, Figjam, Usertesting.com, Google Analytics

Problem

Problem

Alliant had no prior mobile lending patterns, creating both a UX challenge and an opportunity. Members experienced the existing credit card application as overly long, confusing, and misaligned with mobile expectations.

Key Challenges:

No Mobile Lending Baseline: This was the first lending product, requiring new patterns, components, and compliance considerations

Lengthy Process: High abandonment due to excessive steps and fields

Cognitive Load: Desktop-style density translated poorly to mobile

Competitive Gap: Mobile experience lagged behind peer financial institutions

Research

Research & Insights

Understanding Member Friction

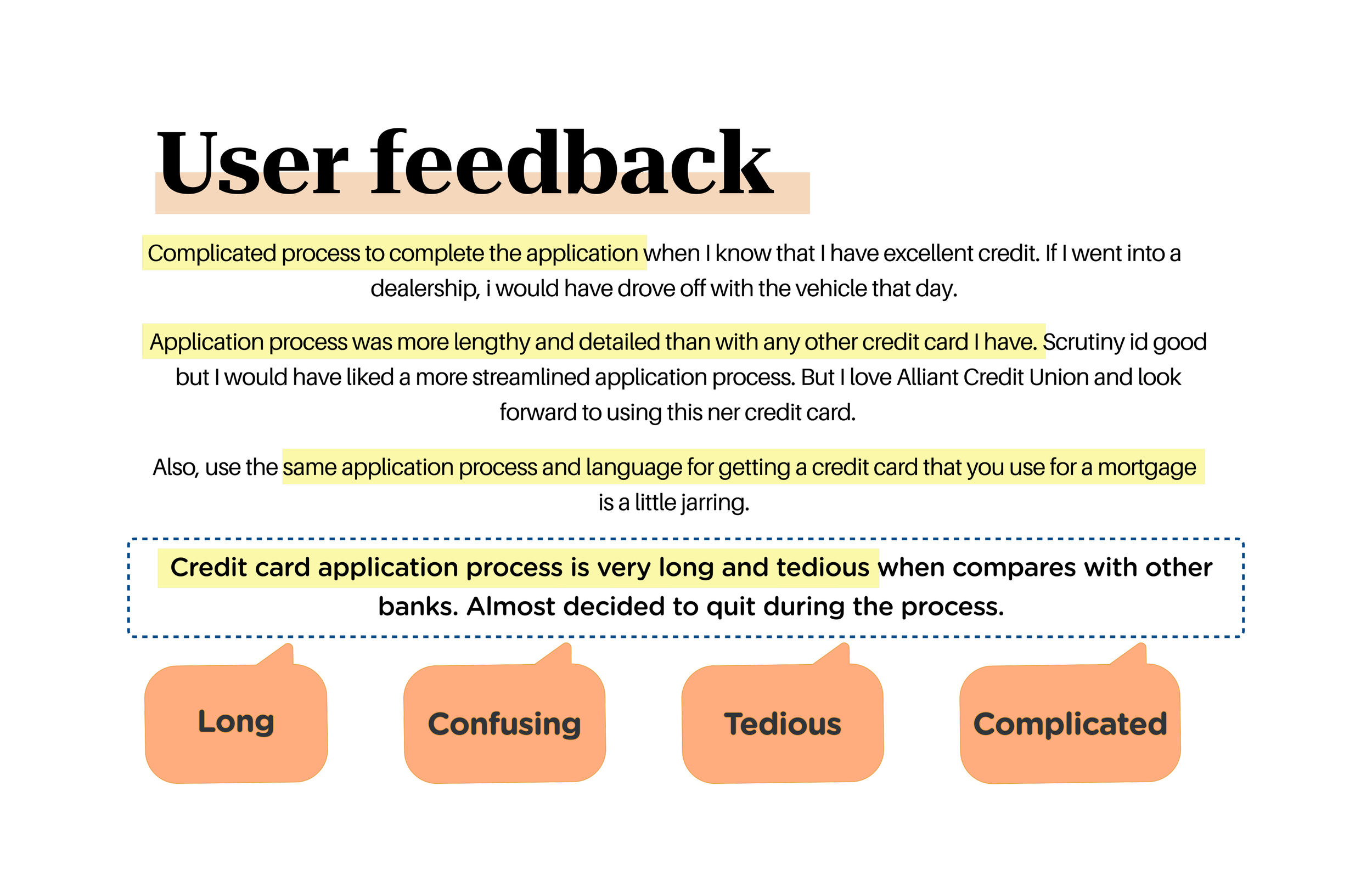

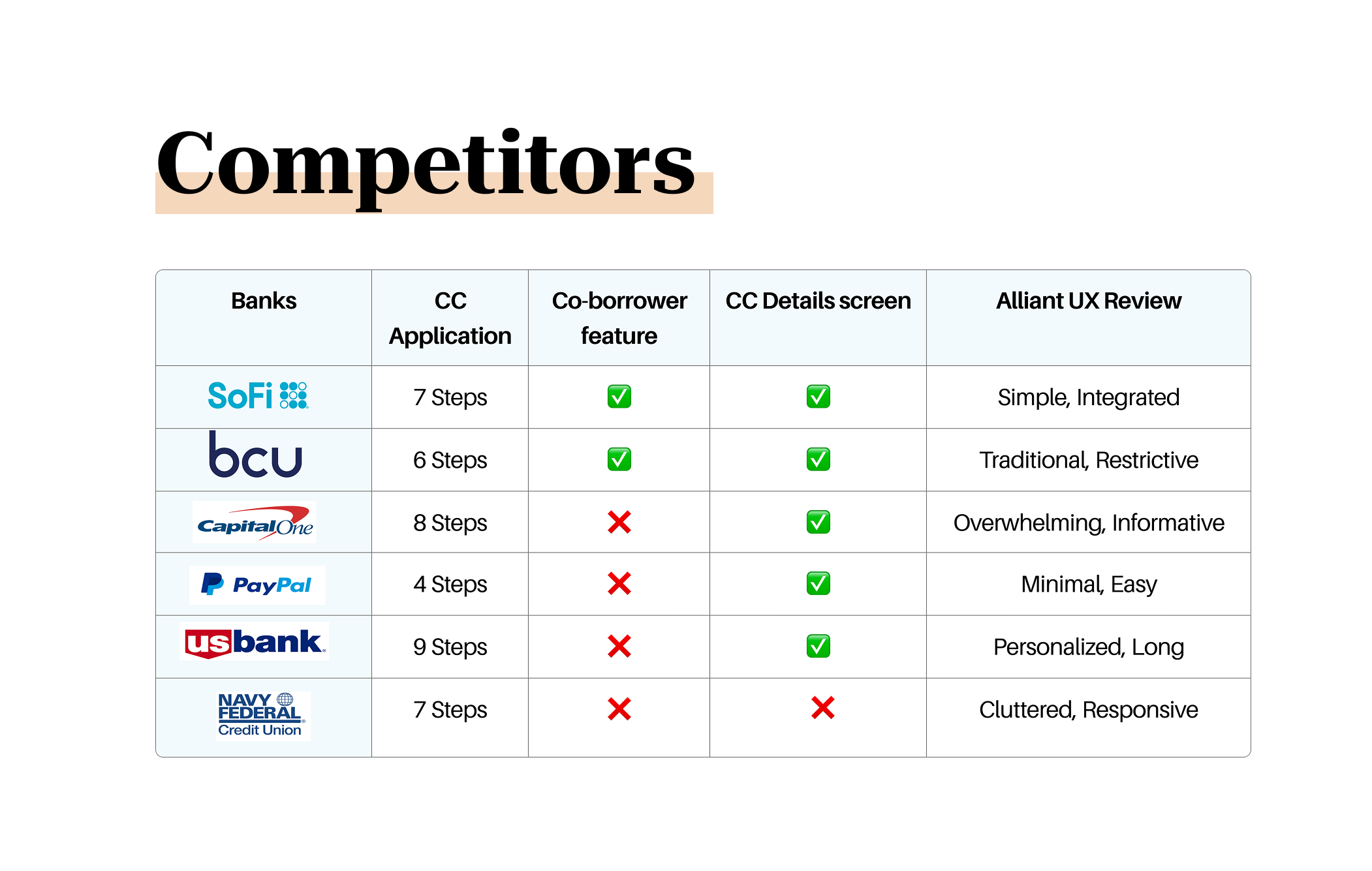

Research focused on identifying friction points within the existing credit card application and understanding mobile expectations for lending experiences. I reviewed Google Analytics application data, DXA heatmaps, and Medallia member feedback, alongside a detailed competitor analysis of leading banks and credit unions.

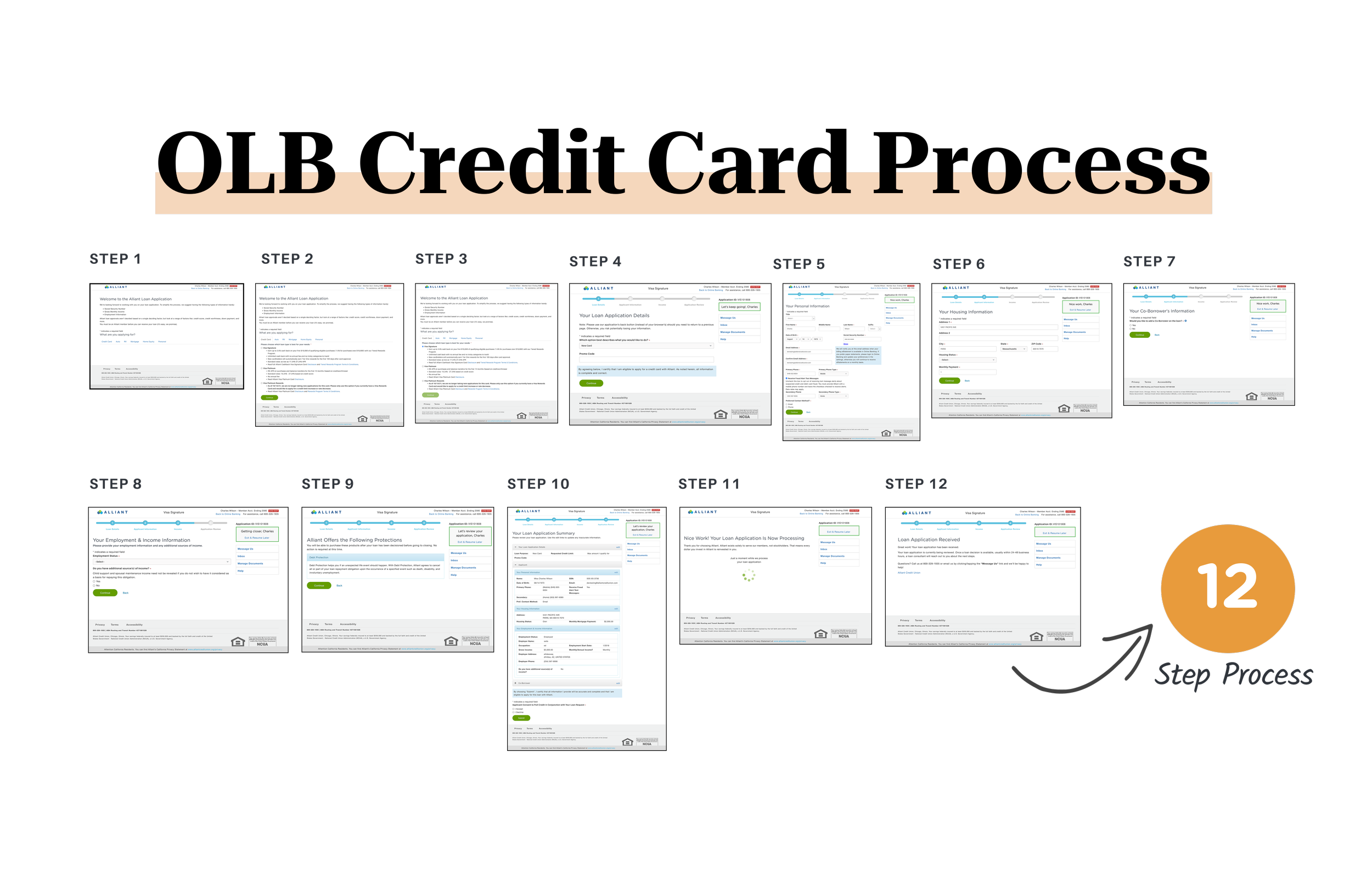

Findings showed a significant gap between Alliant’s 12-step desktop-based flow and competitor mobile experiences averaging 4–9 steps. Member comments consistently described the process as long, tedious, and confusing, reinforcing the need for a fundamentally restructured mobile-first application rather than a direct port of the desktop experience.

Online banking CC application drop off was high

Google Analytics showed 4,807 unique credit card application views in October 2023, but a significant drop between application start and approval.

Competitors Prefilled Data

5 out of 7 competitors prefilled known member information, reducing effort and errors.

Application Fatigue

Member feedback repeatedly described the flow as “long, confusing, tedious, and complicated.”

“Almost decided to quit during the process.” — Medallia feedback

Users Wanted Transparency

Competitors often included a “View Details / Learn More” step to explain benefits upfront, which Alliant’s mobile flow lacked.

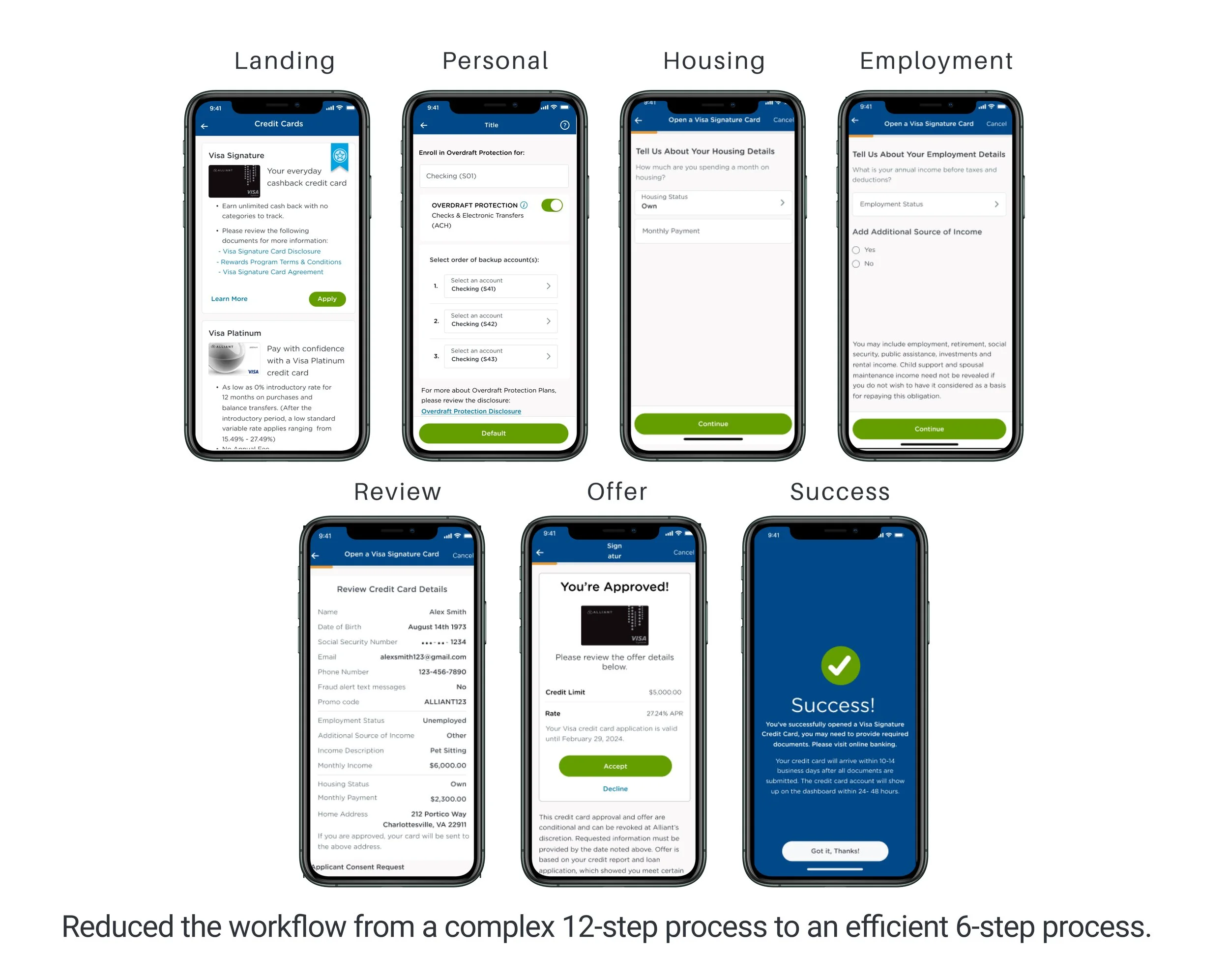

Ideation & Concept

To reduce friction in Alliant’s first mobile lending experience, I re-architected the credit card application from a 12-step desktop-driven flow to a focused 6-step mobile journey. By consolidating related inputs, introducing single-task screens, and applying progressive disclosure, the new design significantly improved clarity and momentum while preserving all compliance requirements. The result was a faster, more intuitive application experience aligned with modern mobile banking standards.

Focus Areas:

Data-Driven Diagnosis: Analyzed funnel analytics, heatmaps, competitor flows, and member feedback to identify structural friction in the existing desktop-based application.

Flow Re-Architecture: Rebuilt the experience as a mobile-first journey, reducing the application from 12 steps to a focused 6-step flow while preserving all required inputs.

Iterative Design & Validation: Developed and refined wireframes and high-fidelity prototypes through close collaboration with product, engineering, compliance, and marketing.

Accessibility-First Execution: Designed and reviewed the flow with ADA and screen-reader support in mind, accounting for multiple employment scenarios and edge cases.

Multiple interaction patterns were explored through sketches and low-fidelity wireframes, which were then narrowed down into two viable concepts for validation.

Process

End-to-End 6-Step Mobile Flow

The application was redesigned into six clear stages:

Landing / Card Selection

Personal Details (prefilled where possible)

Housing Information

Employment & Income

Review & Submit

Offer & Success

This structure replaced a fragmented 12+ step desktop flow and reduced perceived effort while preserving compliance integrity.

Solution

Solution

The final solution delivered a native, mobile-first lending experience, transforming a dense desktop credit card application into a clear, approachable mobile journey. Instead of porting the existing flow, the experience was rebuilt to prioritize clarity, momentum, and member confidence while meeting regulatory requirements.

The application was restructured into a six-step end-to-end flow, replacing the original 12-step process. Each step focused on a single primary task, reducing cognitive load and helping members progress more easily. Known member information was leveraged where possible to minimize manual input and speed completion.

Accessibility was foundational to the solution, with screen-reader support, clear validation messaging, and logical focus order across all steps and employment scenarios. The resulting experience established reusable mobile lending patterns, creating a scalable foundation for future lending products.

Accessibility

What did the users think about the new UI?

Accessibility was treated as a core design requirement, not a post-design checklist. Because this was Alliant’s first mobile lending product, ensuring the experience worked for all member including those using assistive technologies. ADA considerations were embedded throughout the application flow to support clarity, predictability, and equal access across complex form interactions..

Accessibility considerations included:

Screen Reader Optimization: Logical reading and focus order across all steps to ensure the application could be completed end-to-end using VoiceOver and TalkBack.

Clear Labels & Validation: Descriptive field labels, helper text, and inline error messaging designed to be announced clearly by screen readers.

Consistent Interaction Patterns: Reusable input behaviors and button placements to reduce cognitive load for users relying on predictable navigation.

Multiple Employment Scenarios: Accessible flows for employed, self-employed, retired, student, and unemployed paths without breaking screen-reader logic.

This work established accessibility patterns that could be reused across future mobile lending products.

Key Achievements (Post-Launch):

Simplified Workflow: Reduced the application flow from a 12-step desktop process to a focused 6-step mobile experience. The reduction in steps allows for quicker completion times, improving overall satisfaction and engagement.

First Mobile Lending Launch: Successfully released Alliant’s first lending product in the mobile app, establishing reusable lending UX patterns.

Improved Clarity & Efficiency: Each step was redesigned with a single primary task, reducing cognitive load and improving completion momentum.

Accessibility by Design: Built with screen reader and ADA considerations across all application paths, including employment status variations.

Observed & Supporting Data:

25,144 applications started (Jan–July 2025)

15,501 applications submitted

5,654 applications approved

Reduction from 12 → 6 steps aligned with competitor benchmarks (4–9 steps)

“Credit card application process is very long and tedious when compared with other banks. Almost decided to quit during the process.” — Medallia (pre-redesign).

Impact

How much impact did the parity make?

Takeaway

Reflection

This project reinforced the importance of designing financial products that feel appropriate to their context. A credit card application should not feel like applying for a mortgage.

Key Learnings

Designing Under Compliance Constraints: Clear UX can coexist with regulation

Mobile ≠ Desktop: Mobile-first thinking requires re-evaluating every step

Data-Informed Design: Analytics and qualitative feedback together tell the full story